KKN Gurugram Desk | Finance Minister Nirmala Sitharaman has delivered a major tax relief for the middle class in the Union Budget 2025, announcing zero income tax for earnings up to ₹12 lakh per annum under the new tax regime. Additionally, salaried individuals will benefit from an increased standard deduction of ₹75,000, effectively making the tax-free limit ₹12.75 lakh for them.

Article Contents

While the announcement sounded like a huge win for taxpayers, some confusion arose when Sitharaman also introduced a 10% tax slab for income between ₹8-12 lakh. This led many to question the actual tax benefits under the new system.

Let’s break down Budget 2025’s tax changes, new income tax slabs, and what they mean for salaried professionals and business owners.

Key Announcements in Budget 2025: Income Tax Reforms

???? No Income Tax for Individuals Earning Up to ₹12 Lakh

???? Standard Deduction Increased to ₹75,000 for Salaried Employees

???? Revised Tax Slabs with Progressive Taxation for Higher Incomes

???? Middle-Class Taxpayers to Save More Under the New Regime

These measures are expected to provide significant relief to salaried employees, small business owners, and professionals opting for the new income tax regime.

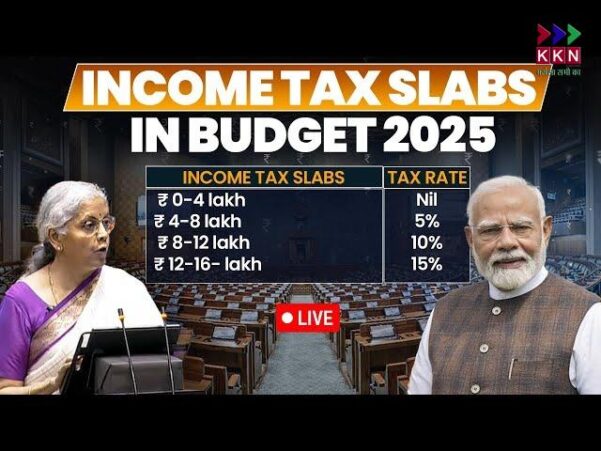

Understanding the New Tax Slabs for FY 2025-26

The government has restructured the tax slabs to make the new regime more attractive. Here’s a breakdown of how taxation will work post-Budget 2025:

| Income Slab (₹ per annum) | Tax Rate |

|---|---|

| Up to ₹4 lakh | 0% (No Tax) |

| ₹4 lakh – ₹8 lakh | 5% |

| ₹8 lakh – ₹12 lakh | 10% |

| ₹12 lakh – ₹16 lakh | 15% |

| ₹16 lakh – ₹20 lakh | 20% |

| ₹20 lakh – ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

Why Are There Three Tax Slabs Below ₹12 Lakh?

While no tax is payable for individuals earning up to ₹12 lakh, the moment income exceeds this threshold, taxation applies in slabs.

For instance:

- A person earning ₹13 lakh will have their tax calculated only on the amount exceeding ₹4 lakh.

- This means different portions of income fall under separate tax brackets, rather than a flat tax rate.

How Will the New Tax Slabs Impact You?

To understand how taxation works under the new regime, let’s take an example:

???? Case Study: Individual Earning ₹13 Lakh Per Annum

Step 1: Deduct Standard Deduction

???? Total Income = ₹13,00,000

???? Standard Deduction = ₹75,000

???? Taxable Income = ₹13,00,000 – ₹75,000 = ₹12,25,000

Step 2: Apply Tax Slabs

- Up to ₹4 lakh → 0% Tax

- ₹4-8 lakh → 5% Tax on ₹4 lakh = ₹20,000

- ₹8-12 lakh → 10% Tax on ₹4 lakh = ₹40,000

- ₹12-12.25 lakh → 15% Tax on ₹25,000 = ₹3,750

Total Tax Payable = ₹63,750 + 4% Health & Education Cess

How Much Tax Will You Save After Budget 2025?

The revised tax slabs offer significant savings compared to the previous tax structure.

| Annual Income (₹) | Tax Benefit in ₹ (Compared to Previous Regime) |

|---|---|

| ₹12 lakh | ₹80,000 |

| ₹18 lakh | ₹70,000 |

| ₹25 lakh | ₹1.10 lakh |

This means that individuals in the ₹12-25 lakh income bracket will save thousands of rupees annually, giving them more disposable income for investment, savings, or expenditure.

Old Tax Regime vs. New Tax Regime: Which One is Better?

With the new tax regime now offering higher exemption limits and reduced tax rates, many taxpayers are wondering whether they should switch or stick to the old system.

| Factor | Old Regime | New Regime (Post Budget 2025) |

|---|---|---|

| Tax-Free Limit | ₹5 lakh | ₹12 lakh |

| Standard Deduction | ₹50,000 | ₹75,000 |

| Deductions (80C, 80D, etc.) | ✅ Available | ❌ Not Allowed |

| Tax Slabs | Higher rates | Lower rates |

???? Who Should Choose the New Tax Regime?

- Individuals without major investments in PPF, insurance, home loans, etc.

- Salaried employees preferring a hassle-free, simplified tax structure.

- High-income earners (₹15 lakh & above) benefiting from reduced tax slabs.

???? Who Should Stick to the Old Regime?

- Taxpayers claiming large deductions under Section 80C, 80D, HRA, etc.

- Those with home loan EMIs, tuition fees, or large medical insurance premiums.

Political Reactions & Public Opinion

???? DMK MP Dayanidhi Maran called the budget “confusing,” pointing out that while the FM announced zero tax up to ₹12 lakh, she later introduced a 10% tax slab for income between ₹8-12 lakh, leading to misunderstandings.

???? Social Media Reactions

???? “Finally, middle-class taxpayers get relief! Zero tax up to ₹12 lakh is a game-changer.”

???? “Government should have simplified the tax slabs further. It’s still confusing for many.”

???? “Will the old tax regime still be better for me? Need an expert to analyze.”

Experts recommend carefully evaluating income sources and tax-saving investments before opting for a regime.

Final Thoughts: How Budget 2025 Tax Reforms Impact You

The Budget 2025 tax reforms are one of the most significant changes in India’s taxation system in recent years.

✔️ Biggest Win: No tax for individuals earning up to ₹12 lakh under the new regime.

✔️ Increased Standard Deduction: Salaried individuals now benefit from a ₹75,000 deduction.

✔️ Simpler Tax Structure: While some confusion remains, the lower tax rates help the middle class.

However, whether you should opt for the new regime or stay with the old one depends on your financial situation. Those relying heavily on deductions and exemptions may still benefit from the old system.