The Post Office Monthly Income Scheme (MIS) is one of the most popular savings schemes offered by India Post, designed to provide regular monthly income. It’s an ideal choice for individuals looking for a safe and steady investment option, particularly those who wish to ensure a secure financial future after retirement. The scheme guarantees fixed monthly income for a specified tenure, making it an attractive option for retirees, senior citizens, and anyone planning for their future financial security.

Article Contents

What is the Post Office MIS Scheme?

The Post Office Monthly Income Scheme (MIS) is a government-backed investment plan that allows individuals to invest a lump sum amount and receive a guaranteed fixed monthly income. This scheme is available at post offices across India and offers a steady, risk-free return, making it a reliable option for conservative investors.

In the Post Office MIS, the invested amount generates monthly interest, which is paid to the investor on a regular basis. The principal amount remains safe throughout the investment period, and the interest income can help manage regular expenses. This is an attractive option for people who want to create a secondary income stream for themselves or their family.

Eligibility for Post Office MIS Scheme

The Post Office Monthly Income Scheme is open to both individuals and joint account holders. Here are the key eligibility details:

-

Age Limit: There is no age limit for individuals who wish to invest in the scheme. However, the scheme is often favored by senior citizens who are looking for a reliable monthly income after retirement.

-

Account Types: Investors can open either a single account or a joint account under the scheme.

-

Investment Amount: The minimum amount required to invest in the scheme is ₹1,000. There is no upper limit on the investment amount, but the interest payout will depend on the total investment made.

Post Office MIS Scheme Interest Rate and Payment Frequency

The Post Office MIS Scheme offers an interest rate of 6.6% per annum (subject to change based on government notifications). The interest is compounded monthly and paid out every month. It means that for every ₹1,000 invested, the monthly income generated will be ₹55, which is credited to the investor’s bank account or can be taken in cash at the post office.

For example, if an investor invests ₹6 lakh in a single account, they will receive ₹3,300 per month as monthly income. Similarly, if the investment is ₹10 lakh, the monthly payout will be ₹5,500.

Investment Tenure

The Post Office MIS Scheme has a fixed tenure of 5 years. After this period, investors can either withdraw their principal amount or reinvest the amount for another term. While the scheme is designed for five years, it provides liquidity in terms of guaranteed monthly returns, making it an appealing option for retirees who need a steady income.

How to Invest in the Post Office MIS Scheme?

The process to invest in the Post Office MIS Scheme is straightforward:

-

Visit Your Nearest Post Office: The first step is to visit your nearest post office. The scheme is available in post offices all over India.

-

Fill Out the Application Form: You will need to fill out an application form for the scheme, which is available at the post office. The form requires basic personal details, investment amount, and account type (single or joint).

-

Submit Documents: You will need to submit KYC documents such as Aadhaar card, PAN card, and a passport-sized photograph for verification.

-

Make the Payment: Payments can be made in cash, via cheque, or through electronic transfer to the post office. You can also make the payment for a one-time lump sum investment.

-

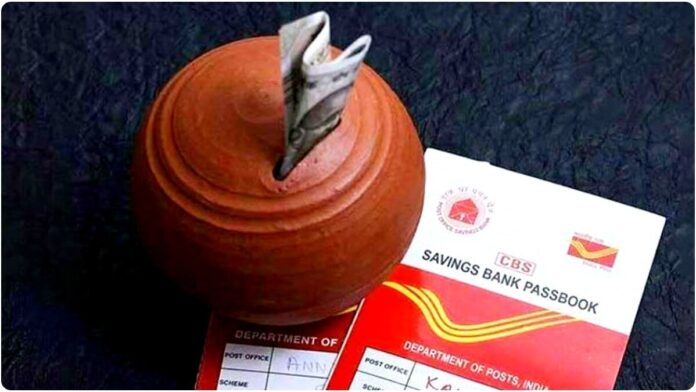

Receive the Passbook: Once your application is processed, you will receive a passbook showing your account details and the monthly income that will be credited to your account.

Taxation on Post Office MIS Scheme Income

While the Post Office MIS Scheme offers a reliable monthly income, it is important to note the tax implications:

-

Interest Income Taxable: The interest income received from the scheme is taxable under the head “Income from Other Sources.” This means that investors will have to pay tax on the interest income as per their income tax slab.

-

Tax Deducted at Source (TDS): A TDS of 10% is deducted on the interest income if the amount exceeds ₹40,000 in a financial year (₹50,000 for senior citizens).

-

Exemption: If the investor’s total income is below the taxable limit, they can submit Form 15G or Form 15H (for senior citizens) to avoid TDS.

Benefits of the Post Office MIS Scheme

-

Guaranteed Monthly Income: The most significant advantage of this scheme is the guaranteed monthly income, making it ideal for senior citizens or retirees who want to rely on a steady cash flow.

-

Risk-Free Investment: Being a government-backed scheme, the Post Office MIS is risk-free, ensuring that your principal amount is safe.

-

Easy to Manage: The scheme does not require frequent monitoring or management. Once invested, you will start receiving a regular monthly income without having to worry about fluctuations in the market.

-

Ideal for Retirement Planning: With its steady monthly payouts, the scheme is perfect for retirement planning. It provides a reliable source of income for retirees who need to support their daily living expenses.

-

Flexible for Single or Joint Accounts: Whether you are investing alone or with a spouse or family member, the scheme offers both single and joint account options, making it adaptable to your needs.

Who Should Invest in Post Office MIS Scheme?

The Post Office MIS Scheme is ideal for:

-

Senior Citizens: Who want a guaranteed monthly income after retirement.

-

Risk-Averse Investors: Those who are looking for a secure investment option with fixed returns.

-

Individuals Looking for Regular Income: People who want to create a passive income stream for themselves or their family.

-

Retirees: Looking for a source of income to cover living expenses without taking risks in the stock market.

The Post Office MIS Scheme is a solid, risk-free option for investors who are looking for guaranteed monthly returns. With its attractive interest rates, government backing, and steady income payout, it is an excellent choice for retirees, senior citizens, and anyone looking to ensure their financial stability in the long term. While the scheme does come with tax obligations on the interest income, it remains one of the safest investment options for conservative investors. For those seeking reliable returns without the volatility of the stock market, the Post Office Monthly Income Scheme is an ideal choice to consider for future planning and retirement.